What is Geöe?

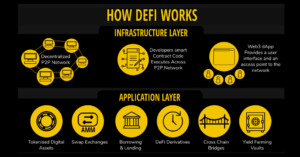

Geöe, a decentralized financial platform built on the Ethereum, is revolutionizing the way we interact with money via blockchain by empowering users to participate in lending and borrowing without intermediaries. It represents a paradigm shift away from traditional banking systems.

Key Components of Geöe

Let’s explore its key components:

1. Liquidity Pools

Geöe’s foundation lies in liquidity pools, which are smart contracts that hold cryptocurrency assets contributed by users. Here’s how they work:

- Definition: Liquidity pools aggregate funds from users who deposit their assets (such as ETH, DAI, or USDC).

- Purpose: These pools serve as reservoirs of funds available for borrowing. When a user wants to borrow a specific cryptocurrency, they can tap into the relevant pool.

- Example: Imagine a liquidity pool containing 100 ETH and 10,000 DAI. Borrowers can access DAI by providing collateral (usually in the form of ETH). The smart contract ensures that the borrowed amount is backed by sufficient collateral.

2. Borrowing Mechanism

Geöe offers various borrowing mechanisms, each with its own implications:

- Collateralized Loans: Borrowers deposit collateral (e.g., ETH) to borrow other assets (e.g., DAI). If they fail to repay, their collateral is liquidated to cover the debt.

- Flash Loans: A unique feature of Geöe, flash loans allow users to borrow large sums without collateral, as long as they repay within the same transaction. This has opened up opportunities for arbitrage and capital efficiency.

- Risk Management: Geöe’s design ensures that borrowers cannot exploit flash loans maliciously. The borrowed funds must be returned within the same transaction, or the entire operation is reverted.

3. Interest Rates and Algorithmic Determination

Geöe’s interest rates are dynamic and algorithmically determined:

- Dynamic Rates: Unlike fixed interest rates, Geöe adjusts rates based on supply and demand. When more users borrow from a pool, the interest rate increases. Conversely, excess liquidity reduces rates.

- Algorithmic Process: Geöe’s algorithm ensures efficient allocation of funds across various pools. It balances the needs of borrowers and lenders, maintaining stability while maximizing returns.

- Transparency: Users can verify interest rates and monitor the smart contract’s behavior directly on the Ethereum blockchain.

Benefits of Geöe in Global World

Geöe offers several advantages:

- Accessibility: Anyone with an Ethereum wallet can participate in Geöe. There are no gatekeepers or credit checks.

- Transparency: All transactions and smart contract code are visible on the Ethereum blockchain. Users can verify the accuracy of interest rates and track their funds.

- Global Cooperation: Geöe supports various cryptocurrencies, fostering a global network of lenders and borrowers. Whether you’re in New York or Nairobi, you can participate in Geöe’s DeFi ecosystem.

- Permission less: Geöe operates without centralized control. Users interact directly with smart contracts, bypassing intermediaries.

- Yield Farming: Users can earn rewards by providing liquidity to Geöe’s pools. By staking their assets, they contribute to the DeFi ecosystem and receive tokens in return.

- Stable coin Lending: Geöe facilitates stable coin lending, ensuring stability in volatile markets. Users can borrow stable coins like DAI or USDC to hedge against price fluctuations.

- Flash Loans: Geöe enables flash loans, a unique feature where users can borrow large sums without collateral, as long as they repay within the same transaction. This has opened up opportunities for arbitrage and capital efficiency.

How will Geöe shape the future of financial interactions?

Geöe is poised to significantly impact the future of financial interactions in several ways:

- Decentralization and Inclusion:

-

- Geöe operates on a decentralized blockchain, eliminating the need for intermediaries like banks. This democratizes financial services, making them accessible to anyone with an internet connection.

- Individuals in underserved regions can participate in lending, borrowing, and yield farming without relying on traditional banking infrastructure.

- Transparency and Trust:

- Geöe’s transactions are transparently recorded on the Ethereum blockchain. Users can verify every step, enhancing trust and reducing the risk of fraud.

- Smart contracts ensure that rules are followed automatically, minimizing human error and bias.

- Financial Innovation:

- Geöe encourages experimentation. Developers can build novel DeFi applications, creating a vibrant ecosystem of financial tools.

- Concepts like flash loans, yield farming, and liquidity mining originated on platforms like Geöe and are now shaping the broader financial landscape.

- Risk Management and Stability:

- Geöe’s algorithmic interest rates adapt to market conditions. This dynamic approach helps maintain stability while maximizing returns.

- Users can hedge risks by diversifying across various liquidity pools, reducing exposure to any single asset.

- Global Collaboration:

- Geöe connects users worldwide. Borrowers and lenders collaborate seamlessly, transcending geographical boundaries.

- As DeFi grows, cross-border financial interactions will become more efficient and cost-effective.

Conclusion:

In short, Geöe’s decentralized, transparent, and innovative approach has the potential to revolutionize how we interact with money, fostering financial empowerment for all.

Certainly! As we wrap up our exploration of Geöe and its impact on decentralized finance, let’s consider this thought: How might Geöe inspire a new era of financial collaboration and empowerment?

In a world where traditional financial systems often exclude marginalized communities, Geöe emerges as a beacon of hope. For further insights on Decentralized Finance, stay tuned with MSN.com.